As an investor, comprehending these measures can go a long way in making informed and intelligent investment decisions.According to BarclayHedge, the average hedge fund generated net annualized returns of 7.2% with a Sharpe ratio of 0.86 and market correlation of 0.9 over the last five years through 2021. Despite its limitations, it plays an integral role in risk-adjusted performance evaluation and should be considered along with other risk measures for a comprehensive understanding of a fund's risk profile. In conclusion, Maximum Drawdown is a crucial risk measure for mutual funds, offering valuable insights into potential losses in the worst-case scenario. It highlights how assessing the potential downside of an investment can significantly impact the overall investment decision-making process. This research reinforces the necessity of understanding MDD as a part of the risk evaluation process.

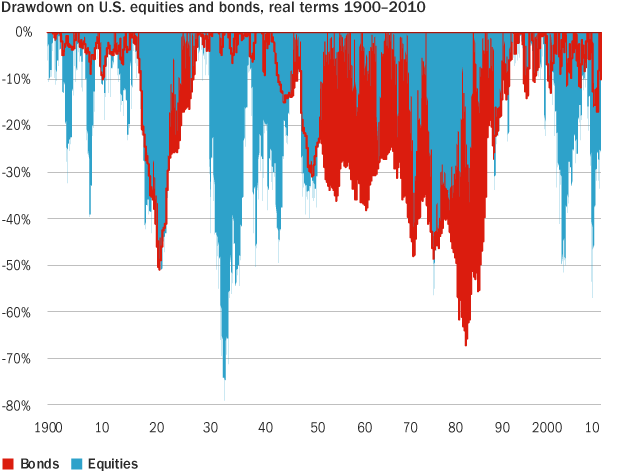

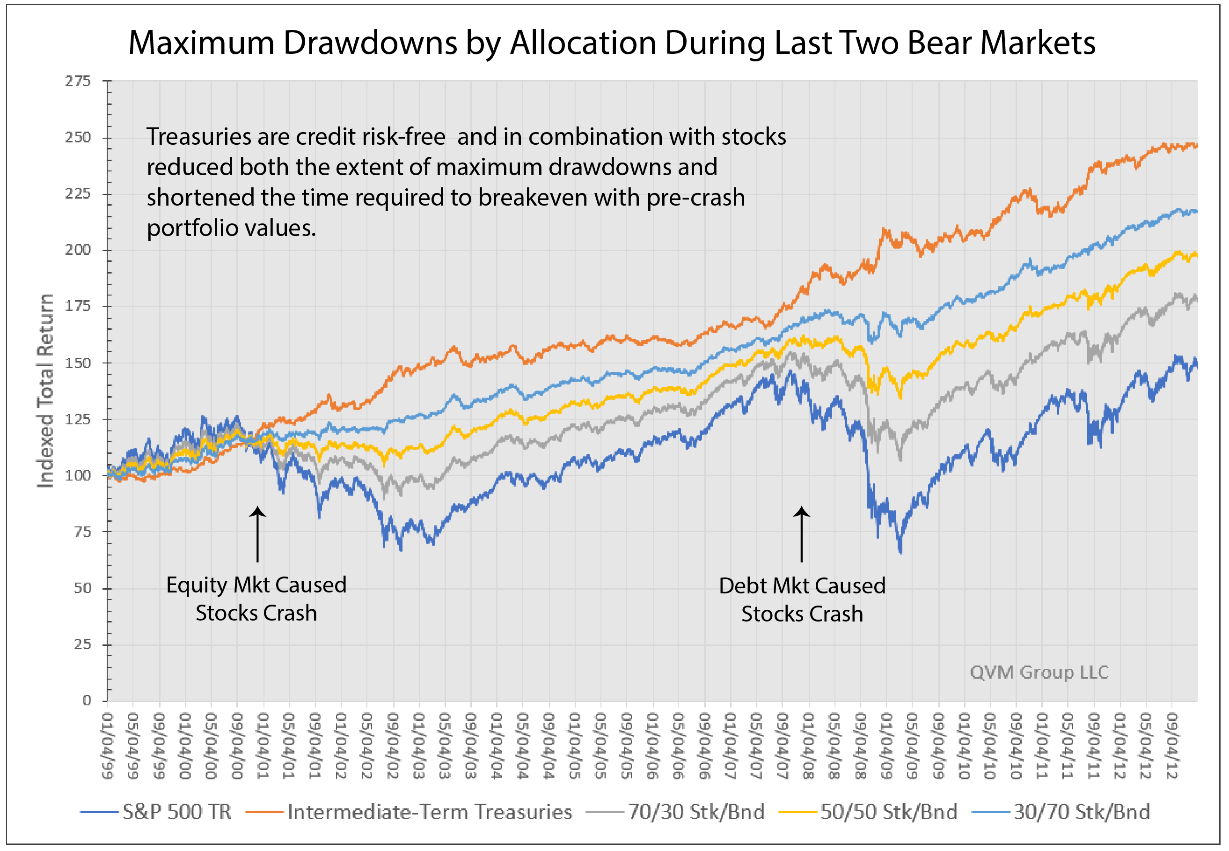

It found that while some funds exhibited high returns, their corresponding MDD was also high, indicating a higher risk associated with these funds. The study underscored the importance of MDD as a risk measure, particularly in volatile markets. Various risk measures, including Maximum Drawdown, to assess mutual fund performance in India. NeetuJuneja (published in 2019) looked into Top Performing Debt Fund Categories for You Top Performing Liquid Funds Top Performing Ultra Short Duration Funds Top Performing Corporate Bond FundsĮmpirical Evidence: Maximum Drawdown in Indian Mutual FundsĪn insightful research paper titled "Evaluating Performance of Indian Mutual Fund Industry Using Risk-return Relationship Model" by Bhanu Pratap Singh and Dr. Useful for Non-Normal Distributions: MDD does not assume a normal distribution of returns, making it a valuable measure for portfolios with skewness and kurtosis characteristics. Intuitive Understanding: The concept of MDD is easy to comprehend - it represents the maximum loss one could have suffered over a specified period. This can be particularly useful for investors with low risk tolerance levels. Unlike other risk measures that rely on variance or standard deviation, MDD focuses on the most extreme losses. MDD is usually expressed as a percentage and can provide valuable insights into the risk and volatility associated with a particular investment.Ĭaptures Extreme Risk: Maximum Drawdown effectively captures the worst-case scenario for an investment. In simpler terms, it gauges the worst possible scenario that an investor could have experienced with their investment. Maximum Drawdown (MDD) is a risk metric that measures the largest single drop from peak to bottom in the value of a portfolio, before a new peak is attained. This blog post aims to delve into the concept of Maximum Drawdown in the context of Indian mutual funds, discuss its advantages and disadvantages, provide a numerical example for better understanding, and cite empirical evidence from research papers. One such risk measure is the Maximum Drawdown (MDD), which is widely used to evaluate the potential loss that an investment could sustain from its peak to its trough. In the realm of investment, particularly mutual funds, understanding various risk measures is pivotal for both fund managers and investors.

0 kommentar(er)

0 kommentar(er)